Bitcoin gave us Blockchain, a decentralized ledger technology. As creative humans, we evolved from Bitcoin & created a plethora of Cryptocurrencies, some legit & some not so legit ones. The onset of ERC20 Tokens opened up a whole new era of Tokens / Coins, which raised millions of dollars from the ICO Market post-2017 boom only to later bust and give up all the gains. While we at Trading Room are focused on creating Technical Analysis & Market Research tools, we keep researching boom & bust patterns in crypto to identify common themes that go beyond Technical Analysis.

As part of our research, we have developed a new matrix called “Whale Involvement & Strength Measure.” also called “Crypto Whale Watching Charts”.

Many of you are here for the Decentralized Ledger Technology, which is going to change the world according to some, but most of us are here to make money. Like it or not, the Crypto industry is full of big whales, medium whales, small whales, and wannabe whales interested in pumping coins as they own a shipload of coins which they bought for next to nothing throw away price. They are like the lobbyists & pressure groups who manage an orchestra of different marketing channels to promote the coins of their interest. Nothing wrong with that as long as the law of the land allows them to play their music.

However, we generally ignore this topic on Twitter when someone tries to raise this & bash these Whale Involvement people as “Fraudsters.” Here is how I approach this topic. We have no issues with these Crypto IndustryWhales as long as they are rich with resources and talent. As long as they use legit marketing channels to promote the coins of their interests, there are no problems.

The problem starts when not so legit projects, with poor wannabe whales, start pumping coins only to dump it hard on their followers. I apply technical analysis to enter and exit trades generally, and it is these charts that make me nauseous as they follow no technical levels. The only thing they follow is the bank balance of the people who are promoting these coins.

This article shows you how to identify a coin backed by Rich whales with experience & resources vs. Poor Wannabe Whales. Follow the coins with a past history of real & sustained gains vs. the ones with frequent large down wicks.

How Many Times Have You Seen The Following Pattern Repeat?

- The coin gets listed the first time or on a New exchange.

- Pumps hard on the Listing Day only to dump later.

- Pump again for the next 3-5 Days by 100-1000 (Don’t forget the first few days of Listing is the period when most investors don’t have access to their coins as Exchange Wallets are under maintenance or not available to deposit the coin until a coin is listed).

- The dump of epic proportion starts after 3-5 days of big 100-1000% dump.

- Coin travels back all the way to the levels where it originally started the Move or even lower.

- Consolidates for weeks on the ground floor.

- Sudden chatter starts appearing on social media about some event, airdrop, partnership & coin starts pumping again (Indication of a Whale presence).

- Sudden PR Buzz through Social Media influencers about a hyped-up event starts pump number 2, which may test 61.8, 78.6, or even previous highs (Whales Active here).

- The Pump continues for several days/weeks only to dump again (in 90% cases).

- The pump’s speed, the volumes, and the sustainability of the pump entirely depend on the so-called Insiders & their ability to artificially “manage” the market.

- More often than not, such pumps are always about Mainnet Launch, Some Big Name Partnerships, Airdrops, etc.

- Pre News pumps are generally always preceded by big-time dumps (Whale accumulating, acquiring from the management at low prices to dump at hyped-up levels).

- Ground Floor levels are back, or even basement levels are achieved with a sustained dump; new lows are tested, retested, and broken on the lower side.

Now, this is where the “Crypto Whale Watching” Matrix comes into play.

Coins with the biggest communities, with most active promoters themselves acting as Social Media influencers, some credibility of a working product, and active whale involvement will soon find buyers on the dips. However, coins with No Active Promoters, No Working Product, No Apparent Use Case, No Community Involvement won’t have a Big Whale presence either, and those coins will most likely languish on lower levels for a lot longer.

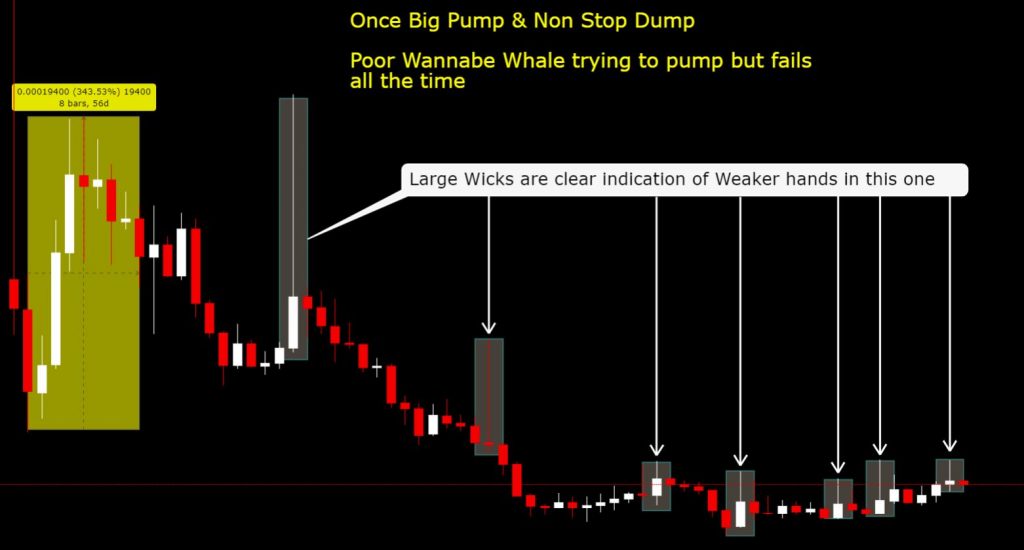

Such coins may still have some whale activities from the management itself, who may try to artificially prop up their prices only to realize they don’t have the buying power to sustain the pump. Remember those big wicks?

Coins with no active whales may still attempt to pump by either the management themselves or some crony investors/wannabe poor whales who may want to practice whaling & therefore, they dabble in such illiquid coins. In most cases, they try to pump something hard but always end up failing as they couldn’t manage enough buying power to sustain the selling pressure.

In a nutshell, every management desires their coin to be the next Bitcoin, Ethereum, BNB, or LTC. And in order to get to that level of investor participation, they end up stitching shoddy deals with whale investors. Now, this is where we, as investors, need to be careful. The coin companies which create these coins may have different agendas, and their agenda may or may not align with our agenda as investors.

The most common agenda for ERC20 or any other tokens is “Raise Money for their business” Now, there are several ways they go about it.

- They sell the bulk of their tokens to Crypto Venture Funds & list tokens directly. In such cases, the Crypto funds become an interested party in promoting the coin. They may deploy all legit marketing channels to help the company gain exposure, which may help valuations for such token companies.

- If they can’t find a Venture fund, they may go to independent ICO Platforms or create their own ICO Website & go solo in the market & try to raise funds by using Social Media Influencers. Now one of two things can happen. They may get all the funds they want and end up selling all the tokens, or they find it hard to meet the Sales Target & end up selling a tiny part of the intended quantum.

- If they sell out, that’s good for them. They get the required funds, and they move on with their business (they should), but in some cases, some of those token companies have many more management tokens to be unlocked over a period of few quarters, which makes them an interested party who wants the token prices to remain at an elevated level. Some of them may indulge in insider trading & trade their own coins by using your ICO Money that you invested in them to artificially pump the price & eventually dump their own tokens when unlocked.

- The classic case of Pump & Dump by Promoters themselves. In some cases, they may engage outside professionals to carry out the day to day market making by using Market Maker bots. Again as long as the law doesn’t think this is illegal, we have no business to discuss legality. All we need to think is A: How do we identify such coins & B: How do we stay away from these Whale Involvement people by Whale Involvement Watching charts when their Dump & Dump business starts. Let the Law take its own course as to if this is legal or not for token companies to get involved in. We are focusing on identifying such tokens and ensuring we stay away from getting stuck during their HYPE phase.

- What if they couldn’t sell their intended quantum during ICO Phase and manage to sell only partially & raise only small money during the ICO phase? Well, then these companies become the most interested party themselves to ensure the tokens pump hard so that they can dump their unsold tokens to raise funds for their project. Now I am not implying all of them are taking this route, but many of them may opt for such a route to raise easy money without the need for any KYC, business due diligence from large ticket investors. Again, let’s not get into the legal part. Let’s only focus on the Dump & Dump Phase when they would start their epic dumping business. We must stay away as most of these tokens may lose up to 100% of their value.

- Why will they lose up to 100% of their value? Because Active Management will no longer be active once their coins are sold. Many of those scammy coin companies will disappear without a trace & the few who stay around will be too busy with their business and won’t have time, money & resources to pump their own coins anymore.

In a nutshell, this is Crypto Industry & not stocks. Unless the Crypto has a solid reputation, Solid use case, Great management team, Active presence on social media, real users using the coin in real life towards real utility, then in most case, those coin promoters have nothing much to gain by sticking around to the projects. They were here to milk the space, raise their money & move onto their next venture. Some genuine ones who stay back are too genuine to bother about coin prices and therefore won’t take much initiative either.

in summary, Our most desired scenario for investing in Crypto Industry is:

- Coin with a Real use case with Millions of users using it in real life (Count on your fingertips, who and How many?)

- Active promoter with Social Media Presence (e.g., Vitalik ETH, Justin TRX, or Charlie Lee LTC)

- Huge Community on Social Media (e.g., XRP Army, VET Community)

- Liquid Order Books with Wider Exchange Listings

- Solid multi-month price action history to understand the strength of big-ticket investors & their interest in the coin & their ability to influence each cycle’s prices.

Most of the information is easily available for most known coins/tokens. But how to find some of this information when trading Low Cap coins?

Well, in most cases, you can find most information from the chart itself. Follow these steps to find it:

Rules

- Open the Whale Watching Charts after checking Price Action / RSI / Volume Scanner to find the most trending / top liquidity / top volume coins. (Learn how to use Price Action Scanner)

- Find out the exchange with Longest History.

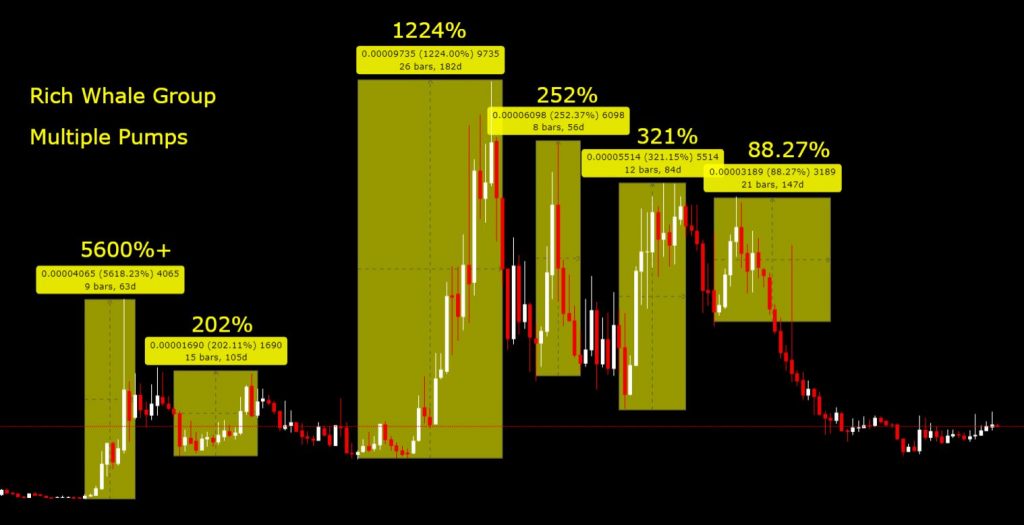

- Measure the strength of CWhale’s Bank Balance. Is he poor or rich? How to Measure? Check past instances of Pumps & dumps. Rich Whales can sustain bigger pumps for a sustained period of time with multiple 100% ++ sustained pumps during the coins’ history. Poor Whales can at best manage to pump prices intra-day / intra-week, and you can clearly see large wicks dotting the chart’s skyline.

- Multiple Large wicks & no sustained pumps in the past suggest the big-ticket investor who was interested in those coins were kinda poor wannabe whales who couldn’t really manage to pump it nicely. In most cases, they would post new lows and continue to trend lower. While such coins can surely pump, those pumps’ sustainability will always below, and they will almost immediately dump back. Now, this can change only if a new set of whales become interested in those coins.

- If the whale is rich, focus on the chart; if the whale is poor, leave the chart & move on next. Why Leave? Well, because those coins won’t respect any TA & move all the time like headless chickens.

- If the whale is rich, use the TA, apply all the rules, and take a position based on your trading strategy.

- This logic is relevant for unknown coins.

- Repeat again

Example of Active Whale Presence

Example of poor / wannabe whales

Example of poor / wannabe whales

I know many of you don’t like the words Crypto Industry Whales & Market Makers, but like it or not, these creatures are part of the crypto ecosystem. Nothing wrong with their presence either. In fact, their presence is absolutely desired as they provide the much-needed liquidity to the market. All we need to do is to learn to identify those coins where whale presence is either missing or some poor wannabe whales are involved who can barely influence the coin prices.

Stay away from weaker hands. Even if you feel a “certain” whale Group, “Investor Group” is involved in promoting the coin, that’s a big plus and not a minus here. Just be prepared with your parachute to jump before they start their dump.

Legal Disclaimer: The Article is intended for educational purposes only. We believe there are always good and bad players in every industry, and crypto is no different. Let’s focus on identifying Strong players & make money & stay away from weak hands. We don’t endorse any coins/people mentioned in this article either positively or negatively. The references are merely for educational purposes only. Any co-incident to the real-life scenario is purely incidental.

Great article

Great insight! You are amazing. Learned a lot from this article.

lovely

Amazing insight! You are wonderful, helping community without monetary benefit

This article is soooo worth to read..love and respect frm johor bahru!

Well written and great content

Top and quality information.

Great content. Thank you

Thank you for your insight!

Not only full of information but also fun to read. As always. Thank you! Maybe someday we’ll get to read a novel “Whale diaries” or some new Letters from Whale 🙂

another fantastic read and Thank You for sharing your knowledge, experience and insight into a market most are very confused about.

Great article

Great article !

Excellent article. Thank you trading room