According to our US markets open overview, Bitcoin is still gyrating between 7 EMA & 200 MA in Weekly Timeframe. Only a clear break above 7 EMA opens up 5100 Area, with a potential extension to 6200. On the downside 3290 continues to be a major support followed by 3150. The Doom & Gloom scenario activates only on a clear break of 200 MA on the downside in the weekly chart.

As long as 200 MA holds, the probability to bounce from here is higher. While Bitcoin is in sleep mode, there is a plenty of action on the ALTs side with plenty of popping higher left, right & center. Lets first Check Bitcoin Trading Chart. for now Trading Range is restricted to 3150-4150

Ethereum is hovering in a small range, we will be buying the dips as per our yesterday’s analysis that kind be found here

US Markets Open Overview – Top Gainers for last 24 Hours includes : (Binance only)

DLTBTC : DLT is up almost 400% in last 2 weeks alone & up almost 800% after posting Lows in Sept 2018. In this week, DLT posted a 50% Pullback and is up again 64% in last 3 days to retest the Highs. On Overall basis, DLT is testing 38.2% Fibo for the Overall Downtrend. Trade Longs with Caution until 38.2% Fibo is breached. DLT is one example of how some coins are likely to deliver 100-1000% returns just by testing only 23.6% or 38.2% pullback without ever going back to ATH.

DOCKBTC : DOCK is up 70% in last 3 weeks from the recent lows out of that 47% is posted in last 24 Hours. DOCK is now facing 100 DMA in daily Chart. DOCK is also facing 38.2% Fib Level for the down move. I dont see any other resistance on the top but 100 DMA may hault its progress for sometime. Trade with Caution. Recommended to buy the Dips toward 230-240 Area.

Other Top Movers includes OAXBTC (I will stay away for low volumes)

Our REP Call earlier did well. Wanted to buy ARN on the dips but looks like yet another shitcoin which may dump heavily (thats the pattern for that coin in past)

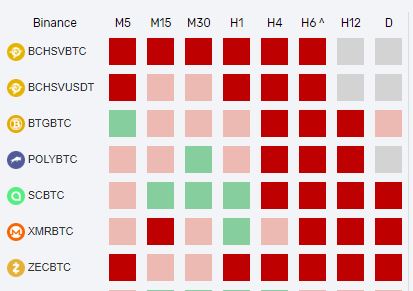

In terms of Down Trend, BCHSVBTC is really staring at the bottom. I like the 40-45 Area for the USDT pair if we get there. BTGBTC looks like it wants to go to zero. POLYBTC is tending weak. SCBTC needs some big whales action soon otherwise its a sinking ship. Monero needs a whiteknight too to bring it back to its glory days and last but not the List ZEC looks like a forgotten coin at the moment, someone needs to revive these coins soon before they vanish.

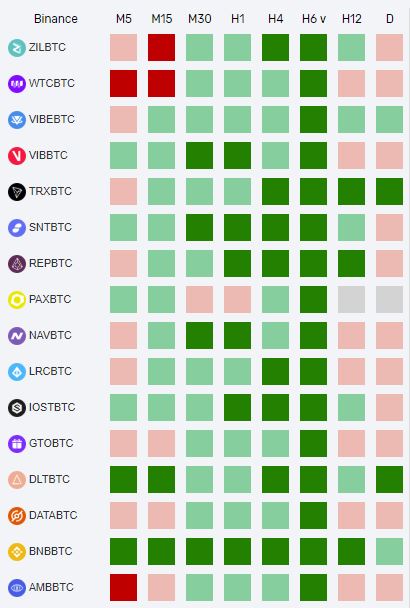

Here is a list of coins which are reversing the Tide in Local Time frames & looking for bigger action in larger timeframes

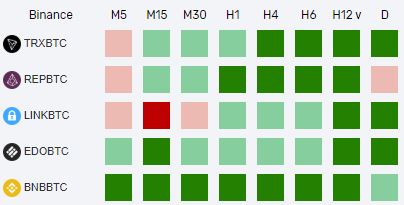

And last but not the list, here are the Top Trending Coin Pairs at the moment, that may have a lot more juice left & continues to be a Strong BUY on the Dips

TRXBTC, REPBTC, LINLBTC, EDOTC, BNBBTC

Thats all for now form US markets open overview, We will be back with European Morning Wrap tomorrow

Let us know if you want help with any specific coins. Please leave a message on Twitter comment.

Legal Disclaimer: This is not a financial advice. All Charts & descriptions provide here is for educational purpose only. Please Do your own Research before taking any trades based on Social Media recommendations.

Love these morning updates!! Brilliant and to the point… Thumbs up!!

Thanks for all the work!!!just amazing:))))

this is a great stop shop – get’s me the most crucial info – and saves me time, that can be utilize for other opportunities. Great work!

Fantastic thank you for all.your great contributions!

unbelievable, this is the kinda stuff that I have been searching for the last 12 month. Thank you for sharing this.

Have been following you guys on twitter for a long time but having just found this blog I will be looking at it each morning (Europe). Think I have sussed the colour coding of the tables but could do with a key somewhere as I am sure many may struggle to interpret initially. Cheers and keep up the good work.