Prior to the 1980s, most stock exchanges were using the open outcry method which involved shouting and using hand signals to buy and sell stocks. With the advancement of technology, this type of chaotic environment has slowly given rise to crypto trading bots that offer more proficient ways to research and trade their stocks.

One of these more modern approaches has been the introduction of automated trading tools called “trading bots” which have been used to perform high-frequency trades without the need for human interference.

What are crypto trading bots?

In simple terms, a trading bot is just a computer program that is connected to exchange and uses the data it receives from that exchange to perform trades. Some examples of the data received would be the trading pair, the time frame, the high, the low and close a candle, or the volume to name just a few.

Each bot is then programmed with a different set of strategies and technical indicators to use in order to perform trades. Let’s now take a look at a really simplistic example of a bot strategy:

Example: User John runs crypto trading bots connected to the Binance exchange and he wants that bot to look at the 15 min timeframe and buy if the 12 EMA crosses over the 26 EMA and only sells when the RSI gets above 70 and the selling price is above the buy price. In that specific example, the bot will only buy and sell if and only if those parameters are met.

What is the use of crypto trading bots?

Trading bots are used by traders who do not want to spend all day looking at charts and actually prefer the idea of automating some of their trades. Furthermore, due to the fact that these bots can perform thousands of transactions per second, they helped revolutionize the concept of high-frequency trading. In fact, according to a study by the Tabb Group, “high-frequency trading accounted for as much as 73 % of US daily equity volume in 2009.”

Since there were not enough reliable sources that could give us an exact percentage of automated trade in the cryptocurrency market, I chose not to include any; however, we can expect a similar or even a higher percentage due to the fact that unlike the stock market which closes at the end of the day, the cryptocurrency market runs 24/7.

In addition, this advantage helped popularize the creation of crypto trading bots specifically designed for the cryptocurrency market as we have seen catchphrases such as “make money while you sleep” used in the promotion of those bots. Some other examples of popular strategies used by trading bots are arbitrage and market-making.

Some misunderstanding about crypto trading bots

First of all, let me mention that I am a fan of automation and use it as much as possible in my line of work. I have also built my own bot and I have used and tested some of the best commercial trading bots out there. However, crypto trading bots have often been erroneously romanticized as these “magical devices” that anyone could acquire and compete with the best traders out there.

If you previously thought that was the case, then you couldn’t be more misguided. Even though we have seen some of the most advanced trading bots use “Machine Learning” to try and predict a change in market sentiment in order to catch the best trades, their current level of accuracy is not high enough to replace the more traditional “emotionless” bots that rely solely on indicators configuration.

A trading bot is not artificial intelligence. It will not think for you. It will not figure out the best strategies to use and configure itself to give you the most profitable trades. A trading bot can only be as smart as the person who built or configured it and it will only expect a set of actions to perform and will repeat those actions, nothing more.

Let me give you a few examples using “Gunbot” which is one of the best crypto trading bots in the market. “Gunbot” offers 15 different strategies that can be combined with each other for buying and selling and also offer hundreds of different configurable parameters so that each trader can try and implement their own method of trading. For this example, I will only focus on one simplified method of buying and selling:

Example: Let’s say we are using an EMA-based strategy for both buying and selling methods. First, the bot will let you input your slow and fast EMA settings, then a buy level which will represent the price percentage change that will act as the bot buying signal and finally the gain percentage level which will act as a sell signal. Let’s imagine that you chose the following setting:

- Fast EMA= 8

- Slow EMA=16

- Buy level= 1

- Gain = 2

In this simplified example, the bot will constantly monitor the price and buy when the price reaches 1% below your lowest EMA and will only sell if the prices reach the 2% gain above your buy price. Another one of the pretty cool features offered by Gunbot is the “trail” setting that allows you to input one extra parameter and this will now restrict selling and let you continue riding the uptrend and only sell if the price starts reverting which can give you a higher profit than the one you initially went for.

Now this all looks good on paper, right? But how do you know which EMA to use? Which buy level percentage to go for? Also, if the price dumps and your buy level is set too low, then your bot will catch a falling knife and you will be stuck holding coins because this is exactly what your bot was configured to do. And for the selling, let’s imagine you set a pretty high gain and your coin never reach that level, then your bot will not sell since your selling price is never reached.

Obviously, these are just simplified examples but the point I am trying to make is that a trading bot does not have perfect settings or pre-configuration and you will need to constantly backtest and learn from your mistakes until you find a set of decent strategies that work for you. Finally, even if you do find a setting that works for you, you will most likely not be able to just turn it on and go on vacation and expect crazy profits on your returns since you will surely need to switch between different sets of strategies depending on the market trend in order to remain profitable.

Crypto Trading Bots Advantages

As previously mentioned, when configured and backtested properly, a bot can offer numerous advantages:

- A bot can be an extremely powerful time saver and can assist users in their daily trades. The user, on the other hand, will not need to constantly monitor the chart to try to catch an opportunity when he has a tool that can run 24/7 and can enter trades in less than a few milliseconds.

- Unlike human traders, a bot will solely rely on indicators and configuration and will not trade with emotion; thus, removing greed, FOMO (fear of missing out) during pumps or panic selling during FUD. This can reduce unnecessary losses.

- A bot can monitor and trade a huge number of pairs at the same time across multiple exchanges. I do remember interacting with a trader that had his bots running 43 different pairs across 4 exchanges and was only targeting micro-profits of 0.2%-0.5%(after exchange fees) per trades on lower time frames. This type of strategy allowed him to make a pretty decent daily profit. Thus, a human trader can only focus on a limited amount of trades per day, but a bot can theoretically run an unlimited amount of trades every day and will only be limited by the trading opportunities.

Crypto Trading Bots Drawbacks

- To build a trading bot requires some extremely advanced programming knowledge on top of some technical analysis knowledge so we can safely assume that not everyone can just build their own trading bot.

- For those who cannot build their own bots, there are still a variety of commercials trading bots to use but you will then decide to let a tool that you do not understand use your own money to perform trades since you will most likely not have the ability to perform a code review of their back-end source code. This can incur huge monetary losses if the bot is not coded or tested properly (ex: Critical bug that could force you to sell at the wrong time and incur losses).

- In the past few years, many bots that promised huge returns turned out to be scams. Yes, I know some will say I am getting controversial, but I am not making this statement lightly. Let’s imagine the following example:

If someone tells you that he wants to talk to you about an incredible business opportunity and that you just need to invest some of your money to get some incredible return, you would most likely think that it involves a sort of pyramid scheme and take your leave. Now replace the word “business opportunity” with “trading bot” and you get the same exact result. Please remember that anyone that promises that their bot can give you X percent of return on investment is most likely a scam artist and you should remain as far away as possible. - I have also witnessed a few cases in the past where people offered bots just to gain access to the user’s private API keys and manage to withdraw all the user’s funds and perform an exit scam. You need to know that if you choose to use a bot, you will possibly grant the bot full access to your crypto exchange account.

Is there any safe way to use crypto trading bots?

The short answer is Yes. Now that you know all the advantages and drawbacks from using a crypto bot if you still decide to go ahead and use one, here is a list of checks you need to perform in order to help keep your funds safe:

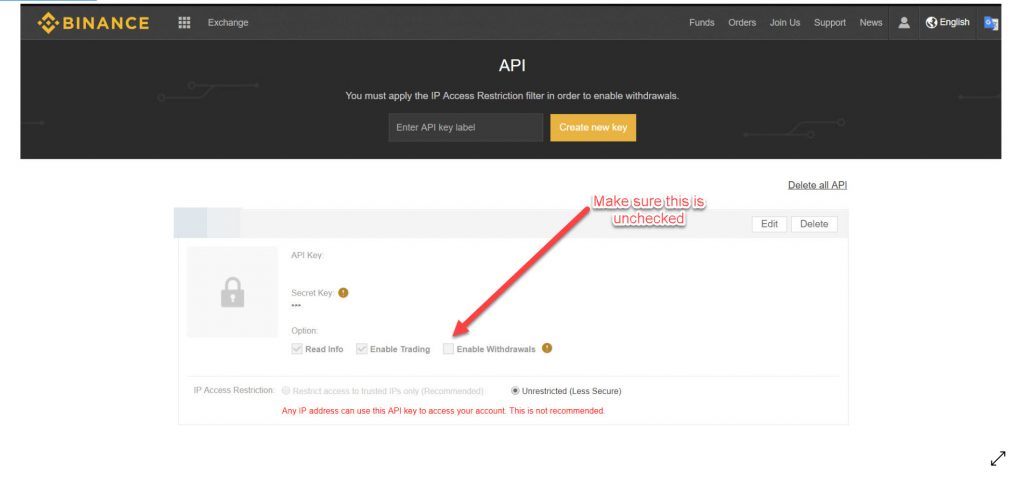

- NEVER share your account username and password or 2FA authentication, a bot doesn’t need those to access your exchange account, it will require what is called an API key.

- Make sure you read about the definition of an API key and how it is used. Here is an article about how to setup one in Binance.

- If you decide to set up an API key, make sure you create a new key every time you switch bots or if you forget your keys. This will revoke the account’s access granted by the previous API key and the exchange will allow you to create new ones easily.

- Make sure you restrict fund withdrawal access to the bot. This feature will allow the bot to only buy and sell coins and protect against scam bots trying to withdraw your money and perform an exit scam:

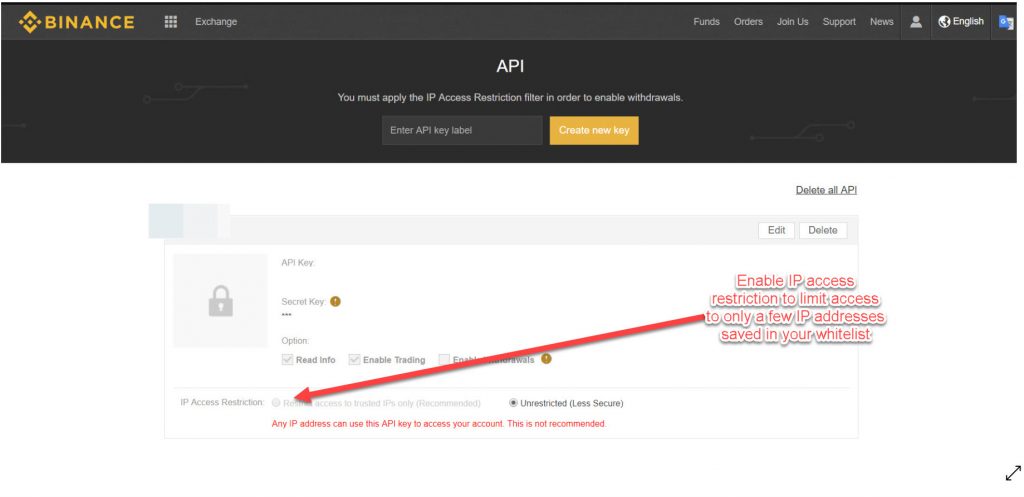

- For extra security, you can restrict access to only a list of authorized IP addresses meaning that even if other people get access to your API key, they will not be able to bypass the whitelisting (never say never though, hackers can possibly bypass this and the exchange security).

Disclaimer: This article only represents my unbiased opinion about crypto trading bots. Any brand of trading bots used in the article should not be construed as my personal recommendation or preference but only as examples used for educational purposes.

About the Author:

Andre S. is a software developer with more than 7 years of experience, a part-time cryptocurrency investor since mid-2017, and currently a novice trader.

He created his Twitter account to document his journey into learning how to trade cryptocurrencies for free and share free resources and tips on a daily basis.

He also enjoys building TradingView indicators that could facilitate learning for newer traders and already released an indicator that offered 8 different EMAs, 8 different MAs, 1 Bollinger band and Ichimoku cloud combined (total of 18 indicators) into a single indicator in order to bypass TradingView 3 indicators restriction for free accounts.

Follow his twitter account for more updates and if you would like to challenge yourself also start learning how to trade for free!

https://twitter.com/Andre_S_Journey