Trading Room is innovating new tools such as Liquidity Index and Volume Scanner to give you a visual snapshot of where the market is heading with an easy to understand UI/UX.

We have earlier launched Price Action Scanner & RSI Scanner & now we are continuing with our Innovation & Launching Volume Scanner with Liquidity Index. Recommended for Day Trading & Scalping. You may selectively use it for Swing Trading also.

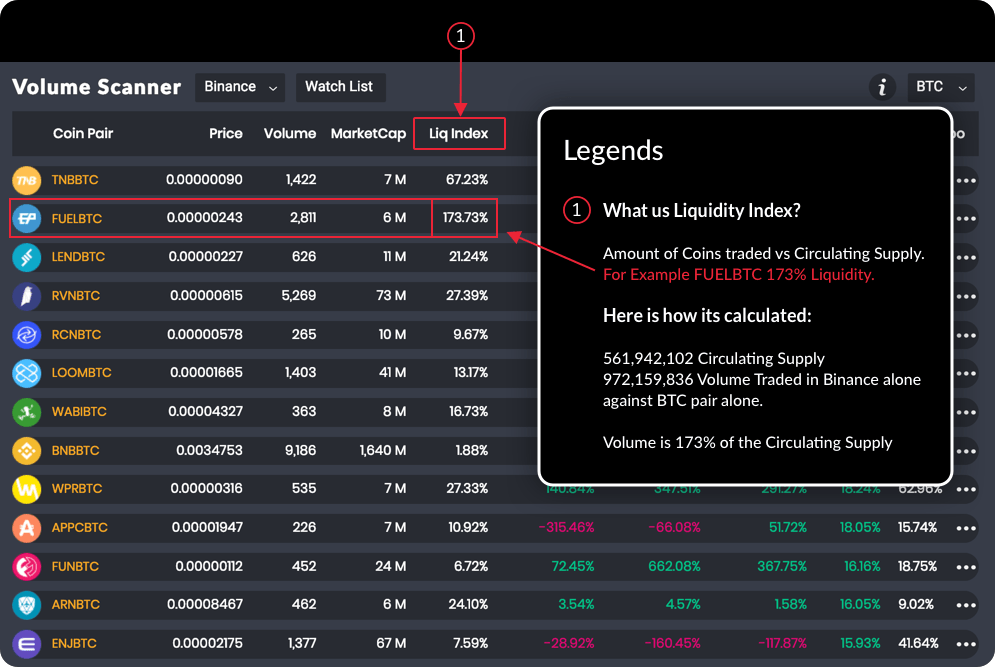

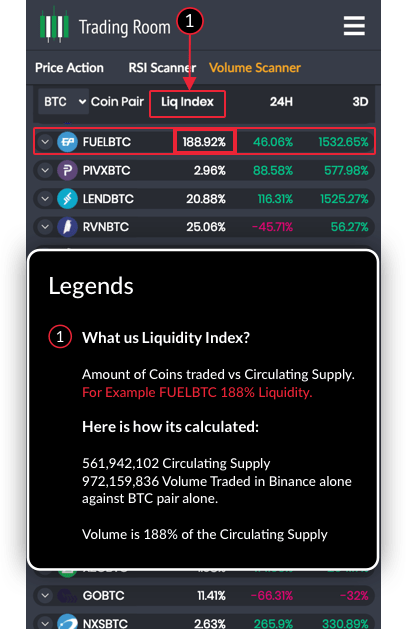

What is Liquidity Index?

How to use Liquidity Index for trading purposes?

Trading Room Liquidity Index is Volume vs. Market Cap matrix or Circulating Supply vs. Volume Matrix.

One of the major issues while trading Alt Coins is Liquidity. It is difficult to get an entry or exit at a reasonable price & spread if the Coin is illiquid & has wider spreads. We will be launching the Trading Room Spread Index soon to compliment the Liquidity Index.

Essentially Higher Volumes = Higher Liquidity = easier to enter & exit with tighter spread. Higher Liquidity also suggests some kind of whale action in the coin, considering the retail crowd cannot push the volumes. Some coins witness as high as 50% or even 100% or more liquidity suggesting strong whale action in those coins. Coupled with other tools, you can find suitable trade setups to trade some of these highly active coins.

What is Volume Scanner?

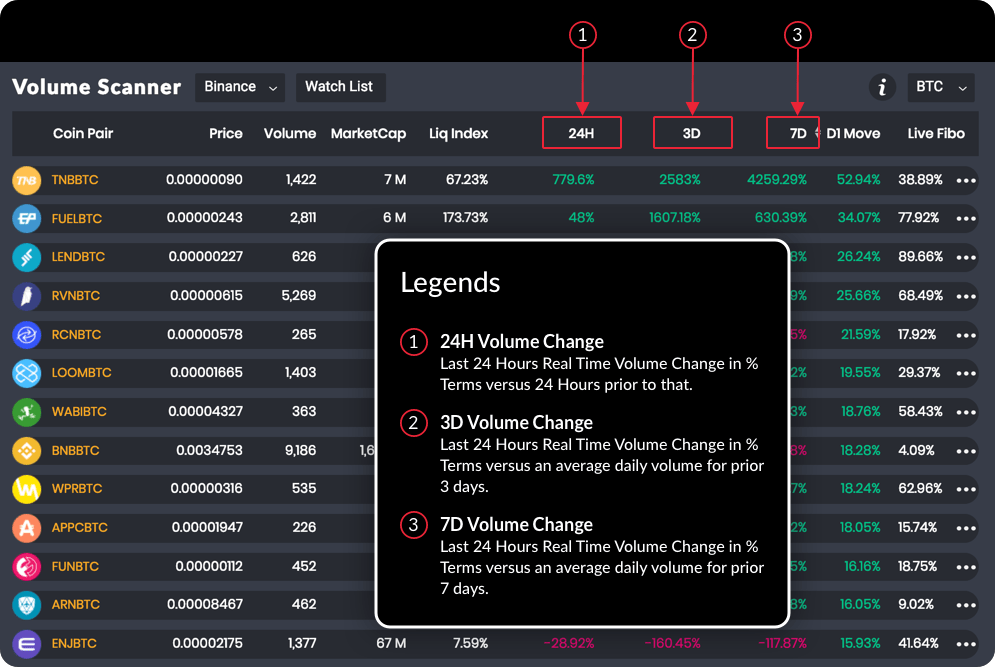

We are analyzing Volume Change in % Terms for 3 Periods.

24H Volume Change: Last 24 Hours Real-Time Volume Change in % Terms versus 24 Hours prior to that

3D Volume Change: Last 24 Hours Real-Time Volume Change in % Terms versus an average daily volume for prior 3 days

7D Volume Change: Last 24 Hours Real-Time Volume Change in % Terms versus an average daily volume for prior 7 days

What does the Volume scanner actually represent?

- Liquidity

- Order Execution

- Activity

- Confluence of Price Action

- Confirmation of a “real” move-in direction

- Strong and Weak Market Moves

- Trend Continuation/Reversal

- Volume Indicators – Volume/OBV

- Money Flow

- Breakouts

Remember, Volume is just one of the indicators to identify the Most Active Assets. Combine it with Price Action tools & you can identify some juicy trade setups.

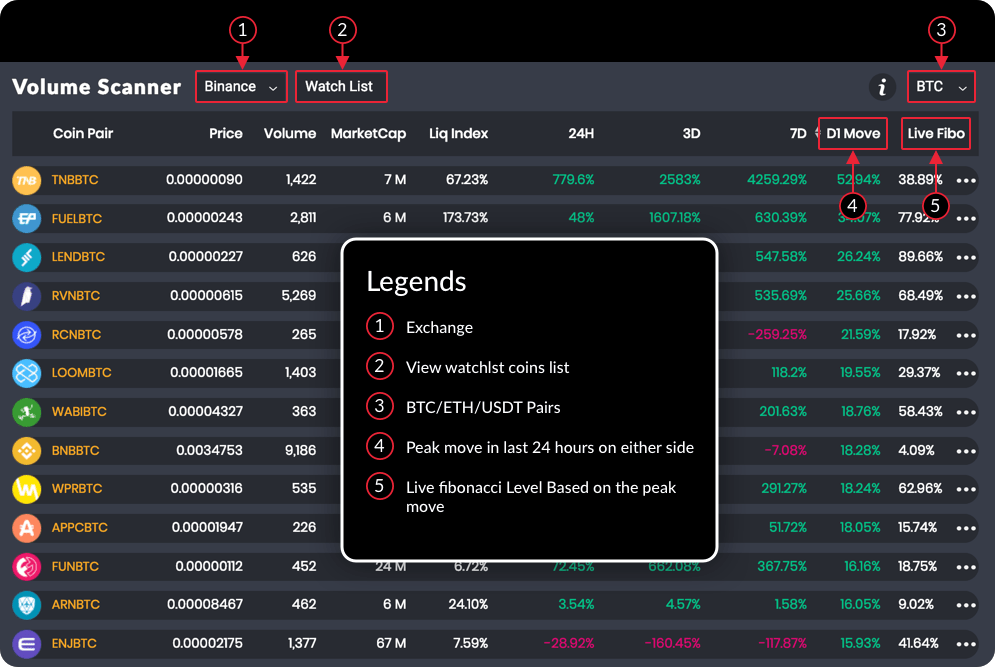

We have included Daily Peak Moves & Real-Time Fibonacci Levels to help you identify the Most Active coins for the day. If you are a day trader or scalper, you will love it. We will arrange a Training Video soon in association with ChingasX.

Volume Scanner Legend

Check: Trading Room Liquidity Index & Volume Scanner Here

Why Trading Room is developing tools like Liquidity Index and Volume Scanner?

The main reason behind these tools’ development is to help you save time and efficiently make your trading decisions. Anyone who can spend one hour a day can trade and make money by learning some simple techniques. We want you to stop wasting time in front of computer/mobile screens trying to find trade setups.

Coming up next:

- Market Monitor

- Live Support & Resistance Levels

- MA Crossovers

- MA Distance Tracker

- And lot more

Liquidity Index and Volume Scanner – Transparency Updates:

No lunch is free & eventually, we need to monetize in order to sustain our operations in the long term. Let’s understand why we offer a free platform and how we can sustain it in the long term.

Trading Room Team is a bunch of passionate traders, developers, designers & educators. We want to help spread the knowledge and help bring mass adoption of trading in general.

Trading Room is a for-profit business. Yes, that’s correct, we are not here for charity, and therefore we will figure out the best possible avenues to monetize and make this into a profitable endeavor. Hence, all stakeholders remain interested in the long term development of the project.

While the platform for Binance crypto will continue to be free, we may monetize by accepting advertisements, sponsorships and offer white label solutions for crypto to other service providers as well as launching paid plans for forex, stocks, commodities, and derivatives or even other Crypto Exchanges.

Let me repeat, we intend to keep our technical analysis tools “free” for crypto for Binance Exchange, which continues to be the number 1 Exchange. The only exception is Alerts. If you want alerts, we can create them, but they won’t be free. We need a different level of Infrastructure, developmental costs, data feeds & maintenance to create and maintain and therefore can’t be provided for free of cost.

Related: How to Use Price Action Scanner

However, we will launch this service only if there is enough demand. If not, let’s focus only on free modules for the time being.

Legal Disclaimer: All Information & Technical Analysis Modules are based on Proven Tech Analysis methods and strategies. However, as always, do your own research before taking any trading positions based on any online or social media posts, including ours.

Liquidity Index and Volume Scanner – About ChingasX :

Chingas is quickly becoming a go-to educator and Technical Analyst on all forms of social media. His roots have always been in the tech world, from developing to building computers, so the transition into Crypto was an obvious choice. Like many, he found Bitcoin in early 2016 and dabbled in the concepts of mining and investing the following year. It was 2017 when he discovered his passion for charting and TA and has since wanted to share all that he’s learned through the countless months of rigorous research and study. He has expressed his teachings thru mediums such as YouTube, Bit.TUBE, Discord, and Twitter. He’s put in the time, the effort, and the work and has mastered how to turn that knowledge into an easy to understand format for traders and enthusiasts of all levels.

https://www.youtube.com/c/ChingasX

https://bit.tube/ChingasX

https://twitter.com/ChingasX

I would pay a reasonable price for Trading Room alerts

I would also pay a reasonable price for Trading Room alerts

Please create the alerts I am interested in paying

im interested, but not for monthly paying – i prefer it like an app