How RSI Scanner Works ?

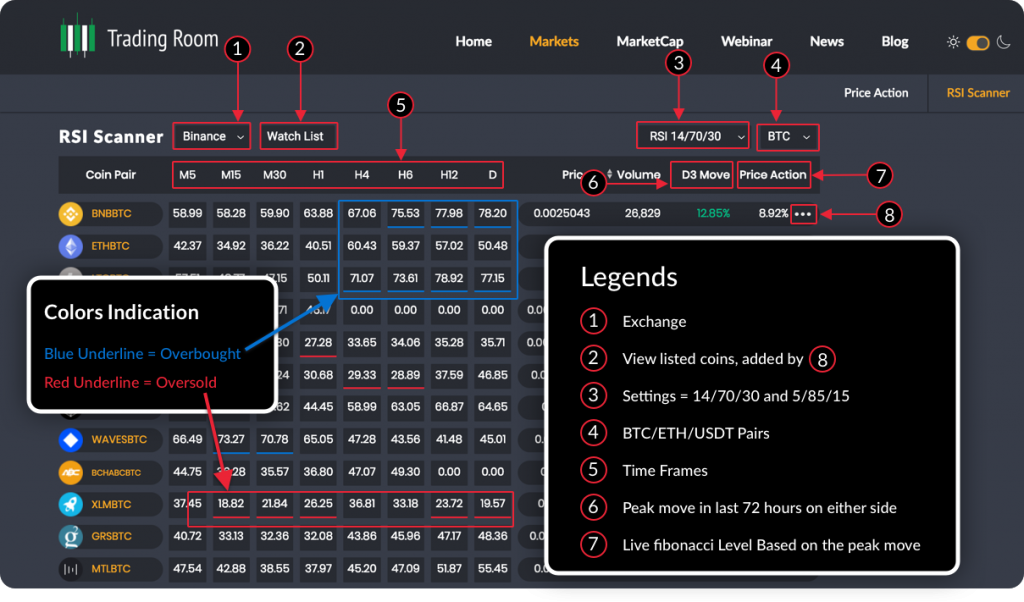

We are tracking 300 coins from Binance across 8 timeframes that translates into 2400 charts and analyze RSI levels in real time (there may be a 5-7 minutes lag sometimes)

What is RSI?

Relative Strength Index

The relative strength index (RSI) is a technical indicator used in the analysis of financial markets. It is intended to chart the current and historical strength or weakness of the asset based on the closing prices of a recent trading period.

The RSI is most typically used on a 14-day timeframe, measured on a scale from 0 to 100, with high and low levels marked at 70 and 30, respectively. Shorter or longer timeframes are used for alternately shorter or longer outlooks. More extreme high and low levels—80 and 20, or 90 and 10—occur less frequently but indicate stronger momentum.

So in nutshell, any value below 30 is considered oversold and values above 70 are considered overbought. That means an asset is oversold or overbought & trend Reversal is around the corner. However, that’s just a theory and not a norm. An asset can remain oversold or overbought for far longer and therefore using RSI on a standalone basis is not advisable. Like any other TA Tools, use RSI to identify interesting charts and apply other tools to identify potential trade setups.

Some day trades master RSI Techniques and exclusively trade trend reversals and make a living out of it. We will show you some RSI tricks in our upcoming webinar on how to use RSI effectively & maximize your returns. We will announce the webinar dates soon.

Here is a guide on how to use RSI Scanner:

We have also added a watchlist. Now you can save your favorite coins and quickly watch them across all modules.

Why Trading Room is developing these tools?

The main reason behind the development of RSI Scanner and our other tools is to help you save time and efficiently make your trading decisions. Anyone who can spend one hour a day can trade and make money by learning some simple techniques. We want you to stop wasting time in front of the computer screen trying to find trade setups. We will introduce more exchanges once we roll out all of our TA tools.

Coming up next:

- Liquidity Index

- Live Support & Resistance Levels

- MA Crossovers

- MA Distance Tracker

- And lot more

RSI Scanner – Transparency Updates:

No lunch is free & eventually, we need to monetize in order to sustain our operations in the long term. Let’s understand why we offer a free platform and how we can sustain it in the long term.

Trading Room Team is a bunch of passionate traders, developers, designers & educators. We want to help spread the knowledge and help bring mass adoption of trading in general.

Trading Room is a for-profit business. Yes, that’s correct, we are not here for charity and therefore we will figure out the best possible avenues to monetize and make this into profitable endeavors so all stakeholders remain interested in the long term development of the project.

While the platform for crypto will continue to be free, we may monetize by accepting advertisements, sponsorships, and offer white label solutions for crypto to other service providers as well as launching paid plans for forex, stocks, commodities, and derivatives.

Let me repeat, we intend to keep our technical analysis tools will be “free” for crypto. The only exception is Alerts. If you want alerts, we can create them but they won’t be free. We need a different level of Infrastructure, developmental costs, data feeds & maintenance to create and maintain and therefore can’t be provided free of cost.

However, we will launch this service in RSI Scanner and other tools only if there is enough demand. If not let’s focus only on free modules for the time being.

Kripto Yorum kontrol edin, ve Kripto Para Tarayıcı

Legal Disclaimer: All Information & Technical Analysis Modules are based on Proven Tech Analysis methods and strategies. However, as always do your own research before taking any trading positions based on any online or social media posts including ours.

Excellent!! But how do i link up with your scanner..Txs

Here you go: https://tools.tradingroom.io/#/rsi

Great work.

Alerts will be more then welcome for ppl who don’t have time and experience,hope the price will be good.

Thank you for everything you do.

WOW

unbelievable

Amazing team and vision! Are you planning to develop a Divergence Scanner soon?

The content you already are providing is worth so much, Huge thanks to you and your team.

Wow Good work !

Thank you for the amazing tool. How can i save the watchlist or do I have to create it every time I open the tool?

Your projects and your team are the best. Looking forward to learning more. Thank you so much.

thank you very much !

You guys are wonderful. Thanks for all you do. You are talented and the visual is brilliant. I don’t want to lunch off you. I would sign up for alerts if it is reasonable which I think it will be.

Will same indicators be available for Forex market as well?

This is platform is awesome – nice work. If you guys are planning on launching a mobile version, I’d be interested in helping build the iOS version.

Can you guys create a module to detect Bitcoin and Altcoins rise and fall by specific percentages setting

Can you add ability to control rsi settings ?

Bigger than (we enter the overbought number) and smaller than (we enter the oversold number) and lenght

For each Time Frame separately

gracias, gracias, gracias, muy buena herramienta de ayuda especialmente para los que empezamos